Case study based on a presentation from Andrew Letherby, Head of Monitoring, Digital Operations, HMRC at the GeoPlace conference 2019

Criminals try to develop credibility and plausibility by using a false address as part of their activity. To do this, they try to ‘register’ themselves, either properly or using an alias, at an address that has some legitimacy, In addition to the impact this has on subsequent victims of fraud, it can also have an effect on people who are associated with the ‘authentic’ address.

His Majesty’s Revenue and Customs (HMRC) is tackling this illegal activity with a cross-department initiative, which uses the Unique Property Reference Number (UPRN: HMRC is launching a pan-government Transaction Protection tool using location data as an anti-fraud measure for the public sector.

The tool has been developed with the Government Digital Service and early efforts are being made to share it with the Department for Work and Pensions and the Home Office, and it will soon be freely available for use by other parts of government.

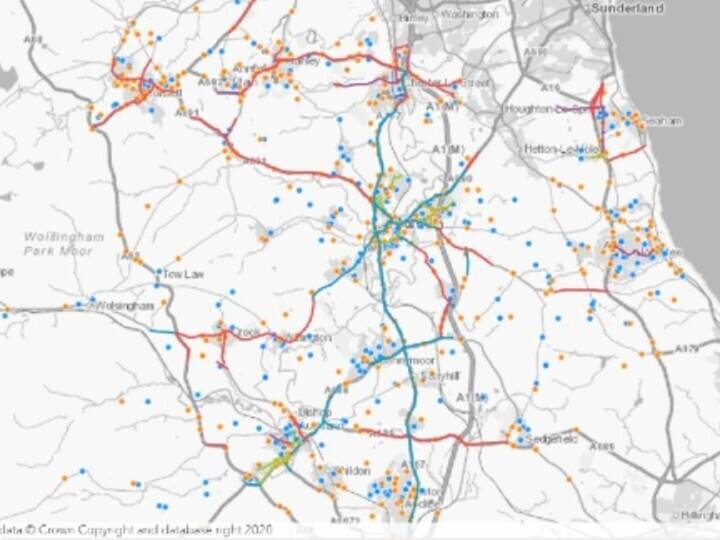

HMRC has created a Transaction Protection tool. This pan government tool draws on OS AddressBase products and the Unique Property Reference Number (UPRN) to carry out checks on an address - known to be registered to one or more government agencies - and to flag up instances that might indicate a risk of fraud

The Transaction Protection tool has been developed with the Government Digital Service. Early efforts are being made to share it with the Department for Work and Pensions and the Home Office, and the UPRN-driven logic engine will soon be freely available for use by other parts of government.

HMRC’s internal address reputation service matches information being submitted by customers to the data held in OS AddressBase. If it correlates (and having recorded the UPRN as a further reference), it is then possible to check that query against other sources to get a consistent match – and therefore a validation.

Those other sources might include government departments, government-backed agencies, banks or credit reference agencies. Queries that don’t correlate precisely are not listed automatically as being fraudulent – but flagged for further investigation.

With future-proofing and interoperability in mind, HMRC is initially working with DWP and the Home Office to build and integrate Transaction Protection tool APIs that will offer a common resource for checking on addresses.

However, there are plans to make this facility available right across central and local government. There are also use cases for this tool in the private sector, in many various contexts.

Because the Transaction Protection tool consumes updates of OS AddressBase automatically, the validation data is as up-to-date as possible.

Other bodies will have the opportunity to use the same tool simply calling on the APIs created by HMRC, although it uses open source code and will be available on the Github platform.

“We aim to have a centralised service available for any government body where you can validate an address, get good quality data matched against that in Address Base, gather your UPRN then map it across.”

-Andrew Letherby Head of Monitoring, Digital Operations, HMRC,