Exemplar Award Winner- Improvement and Efficiency Award Winner 2013: Barnsley Metropolitan Borough Council

The Local Government Resource Review, led by the Department for Communities and Local Government, aimed to increase local decision making and accountability. There were several elements to the review, through two broad phases. The first phase examined the way councils are funded, with the aim of giving greater autonomy and freedom, as well as stimulating local economies. This phase includes a new model which relocalises business rates by enabling councils to retain around 50% of the business rates they collect.

The business rates retention scheme in England was introduced for the 2013/14 financial year onwards. It forms a key driver to ensure the local business rate databases are of optimum quality and hold the most accurate business address information available.

The problem

Driven by these policy developments, Barnsley initiated a review of the processes in place supporting the collection of Business Rates, and the Local Land and Property Gazetteer offered a key way to improve the method of collection.

The solution

The heart of the task involved improving the link rates between the LLPG and local business rate data whilst also reviewing the processes involved in collecting business rate data more generally. The LLPG is linked to the majority of the council’s back office departmental systems. Particularly relevant for non-domestic records are Regulatory Services, Waste Management, and the customer relationship management database. This means that any address change, amendment, addition or deletion must be requested from the LLPG.

The objectives for the project were to:

1. review business processes

2. identify internal departments to contribute data intelligence

3. identify whether any external products or partners could assist. The project was initiated in August 2012 with an aim of completing by the end of March 2013.

The project benefited from access to Ordnance Survey OS MasterMap topography layer, providing a contextual reference point when investigating records.

Outcomes

There have been several key outcomes from this project:

- 23 new premises have been added to the Council Tax and Non-Domestic Rate registers

- site visits are now much more efficient, due to intelligence supplied through the LLPG

- interactions between departments have become much more efficient, due to the common language facilitated by the LLPG

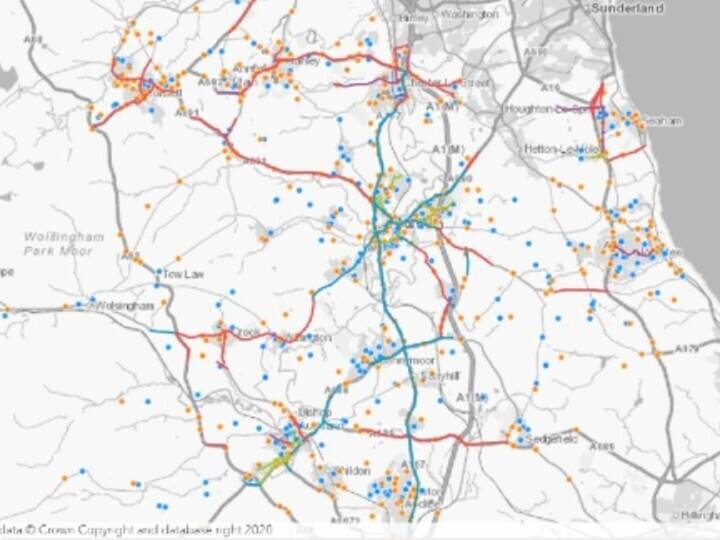

- improved data are shared more widely with other departments via the LLPG and GIS web systems.

The majority of new premises were identified through the third party dataset, and the council calculated the total revenue gain for those premises at £70,137. In addition, premises identified through other means took the total revenue gain to around £100,000, with the total rateable value for all new premises identified within the financial year in the region of £170,000.

Key reasons this project was successful include:

- ensuring the benefits of the LLPG are well understood by all involved

- ensuring a close working relationship between the LLPG team and the Taxation Enquiry Officers – the staff ‘on the ground’

- working towards a 1:1 data relationship between LLPG and nondomestic rate records

- ensuring the Taxation staff have immediate access to the data products created by the LLPG and GIS teams, including the ability to view all of the information spatially

- in addition, benefits were gained because the LLPG is linked to other internal departments which provide change intelligence relating to businesses, including the Regulatory Services, Planning and Waste Management systems; further intelligence is provided via the CRM

- making use of third party data sources where intellectual property restrictions are not impacted.

The project demonstrates the value of the LLPG in supporting the work of the Taxation team in maximising revenues, which is particularly relevant at the current time due to the localisation of Business Rates. As well as quantifiable financial benefits, the council has shown the capability to build on past success to further improve the supporting business processes around the LLPG, with further efficiency gains as a result.

Why this project won

With Business rates being localised, Barnsley wanted to improve collection rates for the taxation team. Building on sound processes and a well-established local land property gazetteer Barnsley has improved how business rates are recorded and maintained. Using the land and property gazetteer as a link to join tax records and property information with internal and external business intelligence information Barnsley improved the process for identifying new or changed business rate records. The project demonstrates good integration of data, good staff collaboration between the gazetteer and taxation team. Increasing business rate incomes and a substantial return on investment demonstrates the value of the approach. The project application was well presented and presented a business case with quantifiable financial benefits. Provide good practice example for other authorities to follow.

Gesche Schmid, Programme Manager, Transparency, Local Government Association and sponsor and judge of the Improvement and Efficiency Award Award

Authority view

“The project provided the Council with a revenue boost which exceeded expectations and provided a significant return on investment. In particular, the use of a new third party data source to help validate the data we hold on businesses proved highly successful, and will be integrated into business processes going forward. We hope that sharing our experience with this project will enable other local authorities to gain similar benefits.”

—Riley Marsden, Geographic Information Officer