An exploration of the best process for keeping Non-Domestic Rates data up to date and the potential benefits

The Authority Address Update Improvement Schedules are designed to provide a plan for the improvement of address data, often referred to as Local Land and Property Gazetteer (LLPG) data within the authority. There are several elements to the Authority Address Update Improvement Schedule. One element is the link rate between what is held in the National Land and Property Gazetteer (NLPG) and the Valuation Office Agency (VOA) Non-Domestic Rates (NDR) data. But why is so much emphasis placed on the link between these datasets, and how can it be improved?

This paper explores some of the drivers behind why it is crucial for every local authority to aim to have a high link rate as possible between their address data held in the NLPG and NDR data. It also examines policy developments including the Local Government resource review and local revenues in terms of the business rates retention scheme in England. While there are some common issues associated with the links between address data and the NDR there are also several ways available to try to overcome these issues.

Why maintaining the data is important

The Local Government resource review aims to increase local decision making and accountability. There are many elements to the review encompassed in two broad phases.

The first phase examined the way local authorities are funded with the aim of giving greater autonomy and freedom as well as stimulating local economies. This phase includes within it a new model which re-localises business rates by enabling councils to retain in the region of 50% of the business rates they collect. The second phase of the review focuses on community budgets.

The business rates retention scheme in England has been introduced for the 2013/14 financial year onwards. This forms a key driver to ensure the local business rate databases are of optimum quality and hold the most accurate business address information available.

Address data captured and created by the Authority Address Custodian ensures address information is input from source - from the point the property plans are submitted to the authority and standardises the data according to a common set of data entry conventions.

The NLPG model provides a Unique Property Reference Number (UPRN) which is a unique key that helps to identify individual properties and units of land, irrespective of change of use. Authority address updates are supplied to GeoPlace who in turn combine this with other data sources and make the data available through Ordnance Survey in the form of the AddressBase® range of products.

At the heart of this data is the fact that it is collected from authorities who have a statutory responsibility to name streets and number properties. As part of this, Street Naming and Numbering officers and the Authority Address Custodians should be recognised as the corporate primary source of address information within an authority. By making use of the authority address data as the corporate address resource, authorities are able to:

- create address information once at source and use it multiple numbers of times, thereby creating resource efficiencies

- access address data created at source, from a trusted team

- link address data together across the council, helping to make the most of council intelligence

- explore all potential sources of address information available in the authority, to aid the development of the best quality address data used to collect business rates

It is important to note that the local government resource review does not apply in Wales however the importance of the linking work is still high due to the other reasons highlighted above.

Common problems and issues

Some Authority Address Custodians have reported that they struggle at times to have good links with their colleagues within the business rate teams. This can be for a variety of reasons but sometimes colleagues in the business rate teams are too busy to consider ways of using new address data.

Additionally, because the NDR data is of primary importance to an authorities’ income, it is vital that the data used is of primary quality. This means that it can be challenging for business rate teams to accept the quality of the data and not be protective over their own data.

More fundamentally, there can be a lack of understanding about the value the Authority Address Custodian and their address data can bring to business rates data. For example, some business rate teams consider that the VOA provides the primary source of address information.

Potential solutions

There are a number of potential solutions; some provide quick wins and others deliver more long term benefits that can be done to improve local business datasets. The following are hints, tips and ideas shared by fellow Authority Address Custodians:

Linking to business rate teams

- “Persistence! – the rating system for LPG-NDR matching won’t go away and neither did I, I just kept going at an admin level and a senior management level until they saw the benefits of the info exchange”

- “Income – all new business rates created after April are kept as income to be spent locally, sell this to the highest level of management you can reach, if they can smell the money then cooperation will follow”

- “We keep a log of new properties created in CTAX/NDR from information shared via the LPG user group, this is used to demonstrate the value of the LPG and provide yearly financial info about the value of the project to the council.”

Demonstrate the value of common address data

- “We keep a record of properties that we have found missing from the rating list that has gone on to be rated and can demonstrate the additional revenue that has been generated”

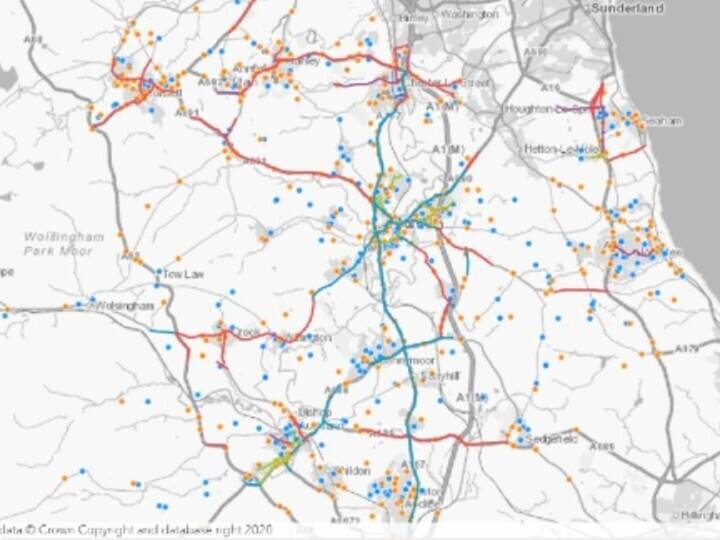

- “Our Business Rates data is used for quite a bit of GIS analysis such as BIDs (Business Improvement Districts), raising additional revenue for flood defences, and various retail and employment projects. This wouldn’t be possible without matching to the LLPG as this is the only source of accurate geocoding.”

- Some authorities state that because they have reached gold level in their Improvement Schedule, this increases trust others have in exploring the use of the data within their authority

- “We have used the notes field in the LLPG to add any info from planning, building control, planning enforcements, CRM, waste services, council tax, business rates and others to build a tool to share information to the readonly group of internal LPG users (admin units all over the council )”

- “Using the LLPG commercial property data we are devising a GIS-based project to map all the LLPG NDR matched rateable properties vs. the LLPG commercial properties so we can see potentially unbanded properties”

- “We keep a record of properties that have been found through the LLPG that were missing from the domestic or commercial Valuation Office lists. To date, we have accounted for 58 properties which equates to additional annual revenue of £89,000.”

Work within existing processes

- ask to be included in change notification emails being sent to the VOA from the Business Rate teams

- download the weekly updates direct from the VOA website so Business Rates don’t have to send updates directly

- work to ensure the authority address data is used corporately throughout the council, even on a look-up basis

- “During all the PAF and NDR matching, whenever I am struggling to locate a commercial property, I quote the NDR reference to the VOA and they provide a location plan”

- “When I identify that they are using an incorrect address I ask our NDR staff to notify VOA of the address change”

A case study from Barnsley Metropolitan Borough Council

“We started out by explaining the theoretical value of good data management - this had limited success. The belief was that “we obtain accurate address data from the VOA, why would we need another source?” So, challenge 1 is to prove that they don’t.

There is no better way of proving this point than by finding properties that are not rated, either for Business Rates or Council Tax. Money really is the winner. Keep a list of everything you report, and make sure the person in charge knows that you are personally responsible for identifying that additional revenue.

The problem is that there is a chicken and egg situation here - really you need a 100% match to NDR and Council Tax (or very close), with cross-references loaded into your system, to do this effectively. We basically did this independently of our taxation department, with them providing weekly extracts from their system, so that the administrative burden is on us. It helps to do this because if they don’t need to provide any direct resource input, you don’t need to convince them of the merits at that stage. You don’t necessarily need them to have UPRN’s in their system and DTF updates for this to work, though it would help.

Once you have this, you’re in an ideal position to identify very quickly if you receive an enquiry from another department about a property that doesn’t have a taxation crossreference. The more systems your LLPG is linked to, the more of these you get – it’s important to put in place a good (user-friendly) feedback mechanism for departments to use.

The next step then is to build a relationship with any visiting/inspection officers your Council has. These are normally people who have been doing the job for many years and are familiar with their existing way of working. You can help them - the LLPG allows you to produce maps (or even intranet-based systems) that will show them the layouts of industrial estates etc. which I can guarantee cause them major headaches. Win these guys over and you’re halfway there because they will see the value of what you can offer and help to explain the benefits of your work to their managers.

A couple of years ago Barnsley MBC won the Financial Award at the Exemplar awards partly as a result of proving that we identified around £80,000 savings/additional revenue from taxation. Since then we have continued to accrue savings and additional revenues in excess of £50,000. We’re also going through a process right now of matching with a commercial business directory supplier and have identified another 60 ‘leads’ which NDR are investigating prior to localisation in April. We will produce a further case study on this in due course, once the financial benefits have been quantified.

One last point though - none of this comes without a major investment of time and effort, which I fully appreciate not everyone has. There is much to be said for building benefits cases and ensuring they’re well communicated within your authority, which in turn makes an impact when you’re asking for the help you need to do the job even more effectively.”

A case study from Fenland District Council

The use of ‘unofficial’ addresses by the council’s Revenue Team had historically caused confusion for customers and duplication of effort for council staff resulting in unnecessary communications and even site visits.

Having identified a possible source of unofficial records as the ‘temporary’ addresses allocated by the Valuation Office when undertaking site visits to rate commercial properties the LLPG Team devised a new working process to prevent this from happening.

Having identified a property requiring valuation - following a merge or split, for example - Fenland Council’s Non-Domestic Rates (NDR) Team would historically send a notification to the local VO. The VO would visit the site and record their information against a temporary ‘unofficial’ address. This report was sent to the council where the NDR Team would attempt to match it against the LLPG.

On occasion, due to the ambiguity of the ‘address’ used by the VO, additional site visits to the property may have been required to clarify the location, or a VO allocated address may have found its way into Fenland’s NDR system.

A new set of working practices was devised and introduced at Fenland District Council. When notifying the VO of a property requiring valuation, the NDR Team provided the official address and UPRN. If the VO had knowledge of a property merge or split, they requested this candidate information from the council before scheduling a site visit or if already on site, they contacted the council to obtain the information prior to completing and submitting their report.

This simple yet effective process based on open communication has led to several key benefits for all parties involved, including the property owner or occupier. By using official council compliant addresses, together with UPRN from the outset, staff at both the council and the VO are experiencing reduced workloads as a result of getting it right first time; the council is generating less correspondence in order to clarify addresses and the customer receives the correct bill at the correct address.

Key benefits include:

- a streamlined efficient work process resulting in the use of addresses by both the council NDR Team and VO

- efficiency savings for both the Council and VO achieved through a reduction in administration with associated cashable savings

- improved customer service with bills issued promptly, to the official address with fewer resulting queries

- a strong working partnership built on mutual understanding with a potential roll-out of the process to other

Other case studies

- ‘Transforming public services with integrated data and geographic information’ describes how Huntingdonshire District Council has used geographic information from Ordnance Survey together with its LLPG. As a result of data sharing, the council estimated that it would incur an additional expenditure of £100 000 if the council had not implemented the geographical information system (GIS) solution and generated an additional £180 000 in revenue.

- ‘Leeds City Council –the benefits of data matching’ explores the benefits of data matching work, carried out by Leeds City Council, between the local address data and council tax and business rates records. Through this work, the team have discovered £92,826 additional annual revenue.

- ‘Salford City Council – making the most of its knowledge’ presents work carried out in Salford by the local address and council tax teams to share their address intelligence. This is with the purpose of ensuring the council has maximum understanding of the changes in the city and in turn ensure residents pay the appropriate council tax revenues and receive the services they require. The improved working arrangements lead to outstanding queries being reduced by 43% over a 5 month period.

- ‘Long term business process re-engineering in Chiltern’. Over the last 7 years, Chiltern District Council has realised significant savings, increased service efficiencies and made significant improvements in customer care by reengineering its business processes.

Further resources

A commons library standard note giving background and further details to the resource review.

A policy that is no longer in operation but does provide useful resources is Valuebill that was a National eGovernment project sponsored by the Office of Deputy Prime Minister (ODPM). Its purpose was to enable electronic exchange of data between local authorities and the VOA, to enhance the collection of Council Tax (CTAX) and Non-Domestic Rates (NDR) through faster, more transparent processes.

Conclusion

This paper has aimed to outline drivers behind why it is important to develop good links between address data in the NLPG and VOA NDR business rate data. There are further resources available at the end of the paper but also do please contact GeoPlace to discuss your data needs further as there may be ways we can help.